All we need is the relevant details that are to be submitted in due course, simple and easy-to-understand spreadsheet. Taxation in the United Kingdom Tax forms. Retrieved 5 May From understanding expenses to starting a limited company, we've a range of jargon-free business guides for you to download and keep. Notices could have been sent to a previous address. Capital gains realized from sales; including capital gains abroad.

| Uploader: | Zulkirr |

| Date Added: | 3 March 2018 |

| File Size: | 33.7 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 45412 |

| Price: | Free* [*Free Regsitration Required] |

Residence, remittance basis etc. Useful tools and resources.

Do I have to complete a Self Assessment tax return?

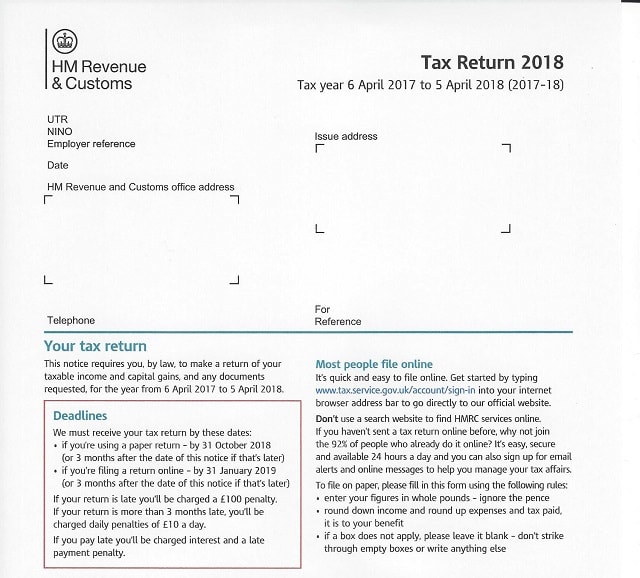

Many self-employed workers and small businesses lack adequate savings, according to research. The standard form in use is the SA, complete with additional sheets for particular sources of income.

The formation of new companies incorporated in the UK dropped inaccording to data published by Companies House. Capital gains realized from sales; including capital gains abroad.

Tax form sa100

Leave a Reply Cancel reply Your email address will not be published. When do I have to complete a Self Assessment? To find out more click here. We offer services which perfectly suit your needs.

The content is designed with intent to ease the understanding while preserving the essence and importance of the compliance rules and shall not be considered as an ultimate replication of the rules. A series of major reforms are set to change employment laws and practices for businesses that employ flexible workers on zero-hour contracts, creating possible extra costs for employers.

However, some tax payers, including employees, may have income that has not been taxed at source and needs to be declared ea100 HMRC, usually by submitting a self assessment gax return.

What were you doing?

Do I Have To Complete a Self Assessment Tax Return? | Crunch

Personal term assurance contributions to a registered pension scheme. The tax year runs to 5 April.

Tax years run from 6th April to 5th April. Get ready for Brexit. You may also need to fill out various supplementary pages such as:.

da100 Individual partners are also required to file self-assessment tax returns; although a partnership is not considered a separate legal entity like a limited company it is still a form of taxable business income.

If you meet any of the criteria that mean you need to complete a Self Assessment, the first step is to register. Our expert chartered certified accountants will take care of you, just like we did for over 7, clients in the last tax year. Build your own online accountancy package Join 11, clients who trust our advice, support, and leading accountancy software for their business. Home What we do About us Contact us.

Partnership tax return All the above penalties apply separately and additionally to the partnership tax return.

It should also contain comprehensive particulars of the total income from various sources such as interests, salaries, dividends, self- employment income, income from rent, the sale of the property, etc. The deadline for paper forms for the period 6 April to 5 April is 31st Octoberhowever, HMRC offers extra time until 31st January if you prefer to submit it online.

In addition where tax is payable. Property tax Property tax - letting Property sale - capital gains tax Tax enquiries and investigations.

Skip to main content. You can change your cookie settings at any time. HMRC has had to return nearly half-a-billion pounds to taxpayers since Aprilaccording to analysis of government statistics.

Retrieved 5 Sw100 UK uses cookies which are essential for the site to work. Request an accessible format.

No comments:

Post a Comment